As a collection agency with offices in Edmonton, Calgary and the GTA we have recognized that over the last 15 years home equity lines of credit have emerged as the driver of mounting non-mortgage debt in Canada — yet many Canadians don’t understand what they’ve signed up for and are not moving to pay them off, a new survey suggests.

The more than three million Canadians holding a HELOC owed an average amount of $65,000, the study released earlier this month by the Financial Consumer Agency of Canada (FCAC) found. About one quarter of HELOC holders had a balance of more than $150,000.

Yet 25 per cent of respondents said they only made the interest payments month to month.

Ipsos conducted the online survey of 4,800 Canadians, most of them homeowners, from June 5-28, 2018, on behalf FCAC, a federal agency that promotes financial education.

HELOCs are revolving credit products secured against the equity in a home. Banks can lend up to 65 per cent of the value of a home. Such lines of credit have been easy to get and banks offer them as a default credit option to anyone with home equity.

Of the homeowners surveyed, 54 per cent had a mortgage and 35 per cent had a HELOC.

The survey suggested there is a lack of understanding among consumers of how these lines of credit work.

Only half of respondents knew basic facts about the terms of HELOCs, such as:

• Banks can raise the rate of a HELOC at any time.

• The bank can demand the balance of a HELOC at any time.

• There are fees to transfer a HELOC to another institution.

• The bank can raise or lower the credit limit on a HELOC.

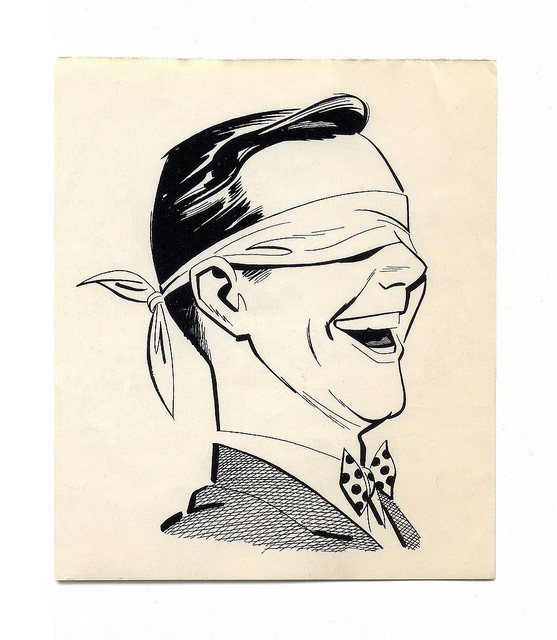

When recognizing such shocking lack of understanding by consenting, responsible, credit worthy adults we are reminded of Thomas Gray’s poem, Ode on a Distant Prospect of Eton College (1742); “Where ignorance is bliss, ‘tis folly to be wise.”