As the financial intelligentsia at the Bank of Canada lose their minds and admonish the public ad nauseum with Canadian consumers debt levels surpassing the $2 trillion dollar mark, 2 blocks east down Wellington street, our myopic legislators continue to carry on like 21 year old college kids on spring break, with mom and dads no limit credit card. Legislators of all stripes also never miss the chance to speak caution and risk mitigation to the public when it comes to personal finance.

Below are a couple of charts to illustrate the duplicitous and hypocritical behaviour of those we look to for leadership.

Thanks Ottawa, for setting such a great example.

Like environmentalists with private jets and multiple homes, a hard drinking alcoholic parent preaching to their kids about the dangers of drinking beer, or a debt collector with bad credit; Do as we say, not as we do.

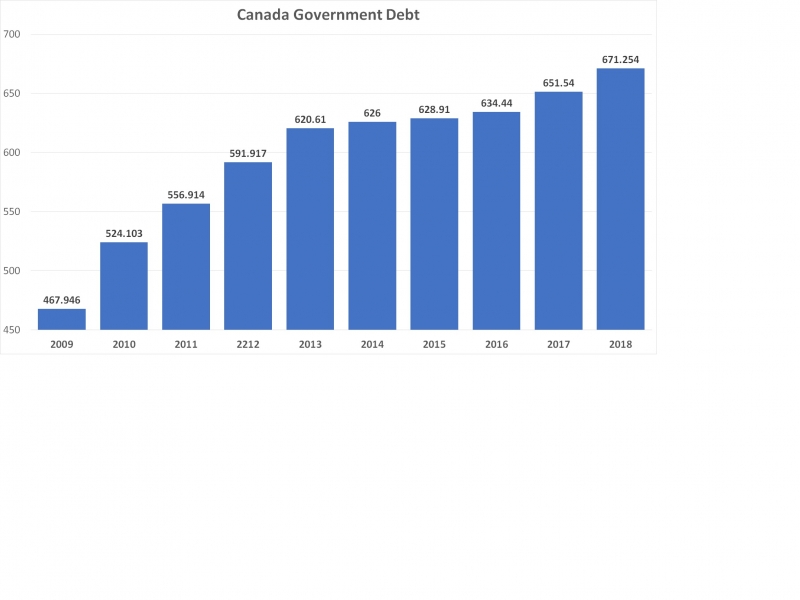

Government Debt in Canada increased to 671.25 CAD Billion in 2018 from 651.54 CAD Billion in 2017. Government Debt in Canada averaged 308.69 CAD Billion from 1962 until 2018, reaching an all time high of 671.25 CAD Billion in 2018 and a record low of 14.83 CAD Billion in 1962.

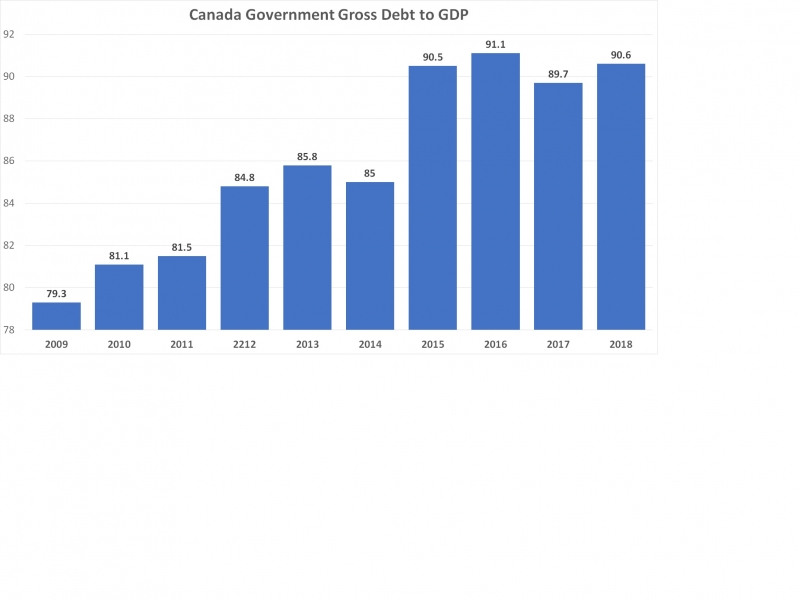

Canada recorded a government debt equivalent to 90.60 percent of the country’s Gross Domestic Product in 2018. Government Debt to GDP in Canada averaged 78.33 percent from 1980 until 2018, reaching an all time high of 100.60 percent in 1996 and a record low of 45.10 percent in 1980.