As a collection agency with offices in Edmonton, Calgary and the GTA we recognize that the majority of consumers we end up dealing with are good people. They have good intentions and have now simply arrived at the tipping point of having to either try to continue to rob Peter to pay Paul or, make some hard choices in monthly budgeting to honour their outstanding financial obligations.

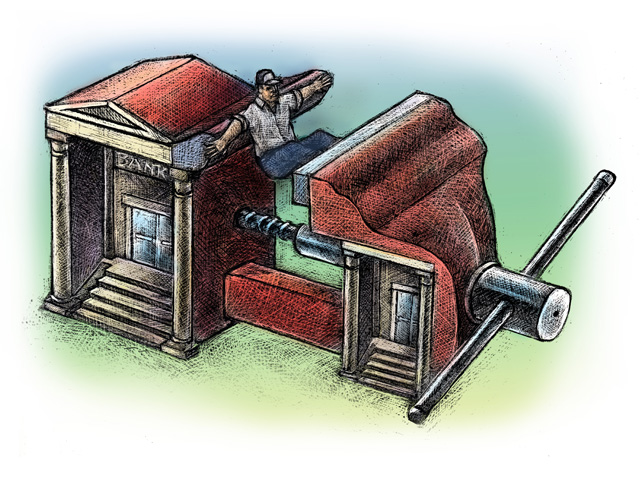

Nonetheless, delinquency rates in Canada continued to move higher during the first quarter of 2019 as consumers continued to pile of more debt according to a new report released from Equifax Canada today.

The report indicated that national 90-day non-mortgage delinquency rates rose 3.5% to 1.12% during Q1-2019. The ‘seniors’ demographic is leading the way rising 9.4% year-over-year. Average debt per Canadian consumer (including mortgages) totaled $71,300 in Q1, moving 2.6% higher compared to the same period last year.

Alberta was the province with the highest average debt level for Q1, reaching $29,117, excluding mortgages. Meanwhile Manitoba was lowest at $18,815.

Equifax also highlighted the slowing mortgage market as a result of increased regulations such as the B-20 guideline imposed by the Superintendent of Financial Institutions (OSFI) in early 2018. The rule imposes a stress test for uninsured mortgages, where the borrower makes a down payment of at least 20 per cent on the purchase of a home. Statistics show that the value of new mortgages was down almost 12 percent year-over-year in the first half of the year.