According to the release of the Bank of Canada’s Business Outlook Survey on July 6, 2020 there were truly no real surprises.

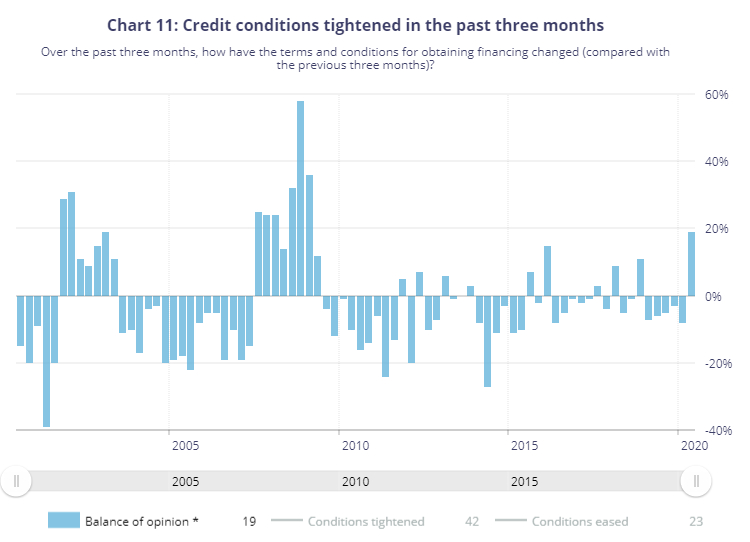

Credit Conditions

Naturally our interest was most focused on credit conditions and as expected the survey reported less favourable credit terms and conditions (see chart 11 below). The survey results were widespread across most regions and sectors. The tightening was commonly attributed to higher borrowing costs or a decrease in the market’s receptiveness to new issuance of debt or equity. Who has ever really had a bank come to their rescue when it was really needed? That never happens. It’s the nature of banking and economics.

We are puzzled how so many business operators forget this during the good times. They fail to build that self-funded fortress balance sheets for the next inevitable black-swan event that seems to happen once every eight to ten years. This has happened throughout history. So how can we build that fortress balance sheet? One sure fire way is to stop being a pushover when it comes to your accounts receivable. But we can help with that and time and continued procrastination is not on your side.

Negative Business Sentiment

We know there is nothing black-swan about the next black-swan. Its going to happen. We know the only unknown or “black-swanish” part of it is what form it will take; a credit crisis, a war, a virus, a meteorite hit, an invasion of green men from Mars? You should know that the only unknown is the what and the exact when. We cannot know that! Black-swans by their nature can’t be predicted or else they’re not black-swans. Make sure you remember this the next time your favourite financial charlatan comes out with their next black-swan prediction. Run, and run fast. I know we do. They are a daft bunch.

By the time of the survey, government programs, Bank of Canada facilities, and loan payment deferrals had started to ease overall financial conditions. Some firms mentioned these programs as helping to improve their access to credit.

Of course! We know the various government programs truly did ease cash flow matters for those businesses intent on surviving a virtual shutdown of the economy over these last 3+ months. But earlier today our Finance Minister Bill Morneau announced a fiscal deficit this year of $343 billion. How will businesses feel when we are inevitably tapped on the shoulder to ‘buck up’ and pay down the deficit? You know it’s coming. It’s not a matter of IF but WHEN and HOW!

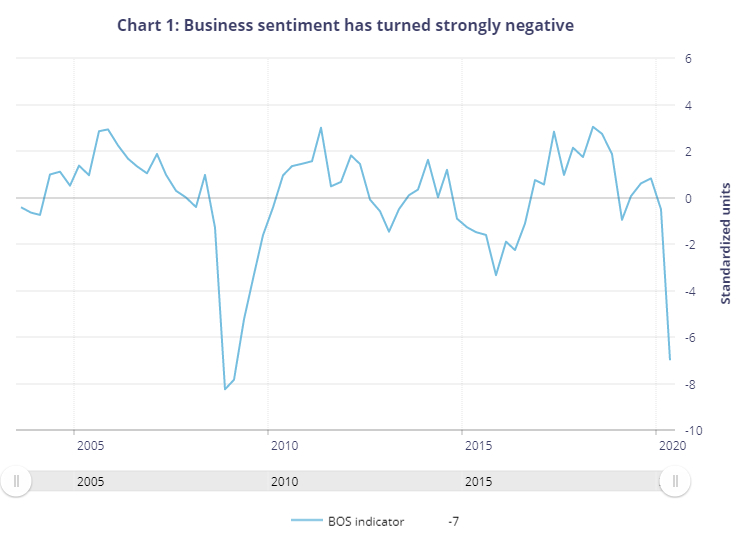

We can only be sure of two things going forward; continued uncertainty for those businesses that have managed to survive thus far and, business sentiment (see chart 1 below) not rocketing back into the positive anytime soon.

It may sound cliché but if there’s one thing that’s certain in business, it’s uncertainty.

For the full Bank of Canada Business Outlook Survey-Summer 2020 go here