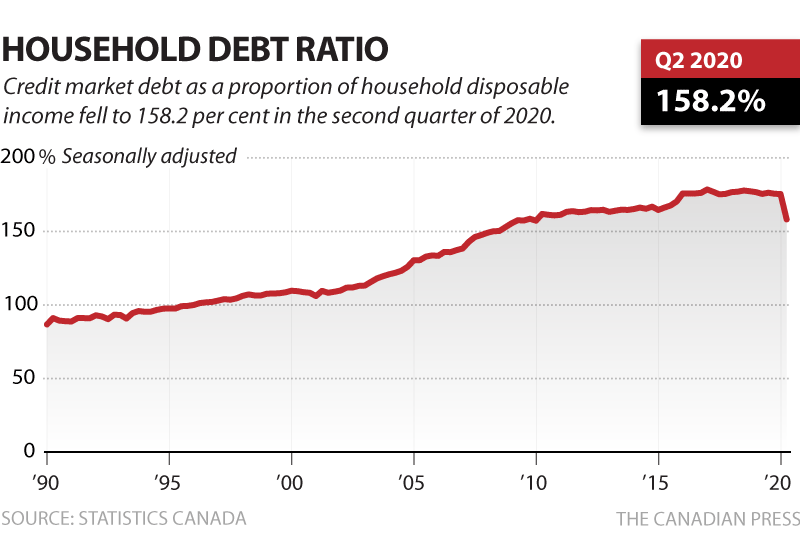

Earlier in September Statistics Canada reported that Canada’s household debt ratio registered a significant decline between April and June from 175% to 158% over the previous quarter. So, in other words Canadians only owe $1.58 for every dollar of income versus $1.75!

Cause for celebration? We think not.

As the government rolled out extensive income-support measures linked to Covid-19 many appeared to do the prudent thing and pay down debt vs. simply spending more. In fact, household spending declined 14% over the same period.

As a collection agency with offices in Edmonton, Calgary, and the GTA we can definitely confirm, based on our trust receipts spiking May through July, many chose to come out of the woodwork unexpectedly and pay long outstanding debt.

But in reality, debt simply came off Canadian consumer balance sheets and was simply transferred to the government’s balance sheet. Meanwhile, as taxpayers us and our children’s, children’s, children remain on the hook. Nice huh?

It’s rather enlightening to realize, from a macro level, we are all apparently living within a government legislated Ponzi scheme. Reality really does suck.