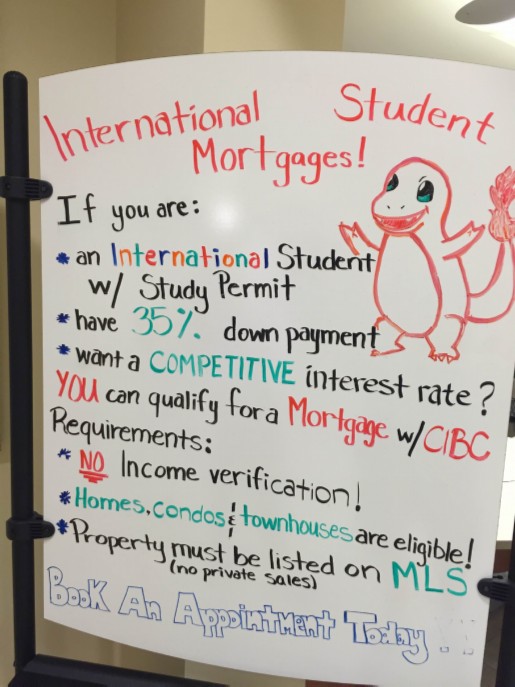

Does anything scream insanity louder than this sign board shown above that was spotted on August 23, 2016 at the CIBC Branch located on the University of Waterloo campus?

-Is home ownership for an international student with a study permit and no verifiable income in the best interest of the student? the bank? or society in general?

-CMHC insurance (in other words mortgages guaranteed by taxpayers) is only a requirement with down payments of less than 25%. Does a down payment of 35% then absolutely guarantee that in the event of the mortgage going sideways, that any associated loses will be limited to the CIBC and its shareholders, and not taxpayers through some type of taxpayer funded bailout? Is this true even in the event of some type of economic financial contagion brought on by the general bursting of the Canadian housing bubble, of which such mortgages as these would be part of?

-Does such a desperate push to this specific demographic by one of the Canadian Big 5 (they are not the only ones, a quick Google search verifies it) tell us we are nearing the end of the list of potential participants in the Canadian housing market that has appeared to have morphed into just another legalized “Ponzi scheme”? Remember, Canadians love to hear with pride that we have the soundest, most stable banking system on the planet.

-Has including the graphic of the Pokémon character “Charmander” resulted in the overall advertising campaign of “International Student Mortgages” being more successful than it would have been if it wasn’t included?

-Is it not the banks but the writer that is the insane one, once considering I’m a 50 year old male that knows that the graphic on the sign is that of the Pokémon character “Charmander”?

Considering the above we suspect as a collection operating in Edmonton, Calgary and the GTA we will continue to have our work cut out for us.