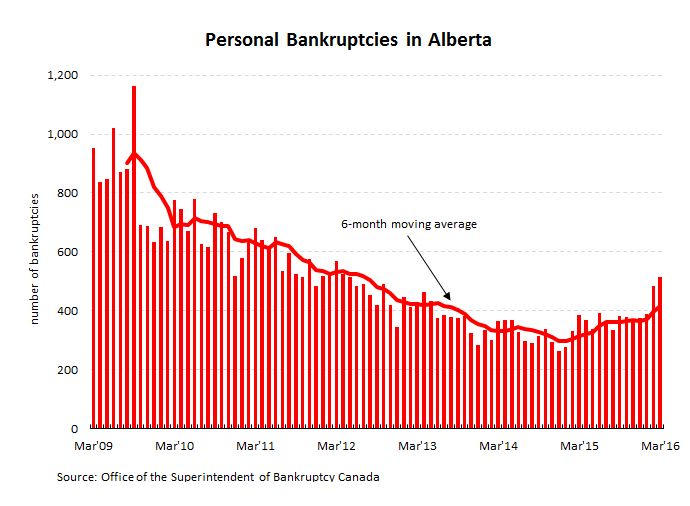

As we reported exactly 13 months ago back in May 2015 when we pontificated that we potentially arrived at an inflection point, the end of the old trend and the beginning of a new trend, for the number of Albertans beginning to experience a higher degree of trouble in paying their debt obligations, recent numbers from the Office of the Superintendent of Bankruptcy have confirmed that consumer bankruptcies have indeed continued to trend higher over the past year.

Although soothsayers may continue to point out that bankruptcy levels have only reached March 2012 highs and that we are still a long way off from seeing bankruptcy levels challenge the peaks of the 2009 recession this should bring little comfort.

Failure of experiencing a dramatic increase in economic activity taking place in Alberta over the next six months we can reasonably anticipate visiting those 2009 highs by the second quarter of 2017 once considering many of those severance packages being doled out in late 2015 will have by then long run out.

We would suggest the prudent granting credit out there to “hope for the best but prepare for the worst” by making the necessary adjustments to their current loan loss provisions in order to be able to weather the coming storm.

Should you be experiencing negative changes in the payment behavior of your customers CASE can help! As a collection agency with offices in Edmonton, Calgary and the GTA we can apply our best professional efforts in order to make your past due accounts receivable a top priority.